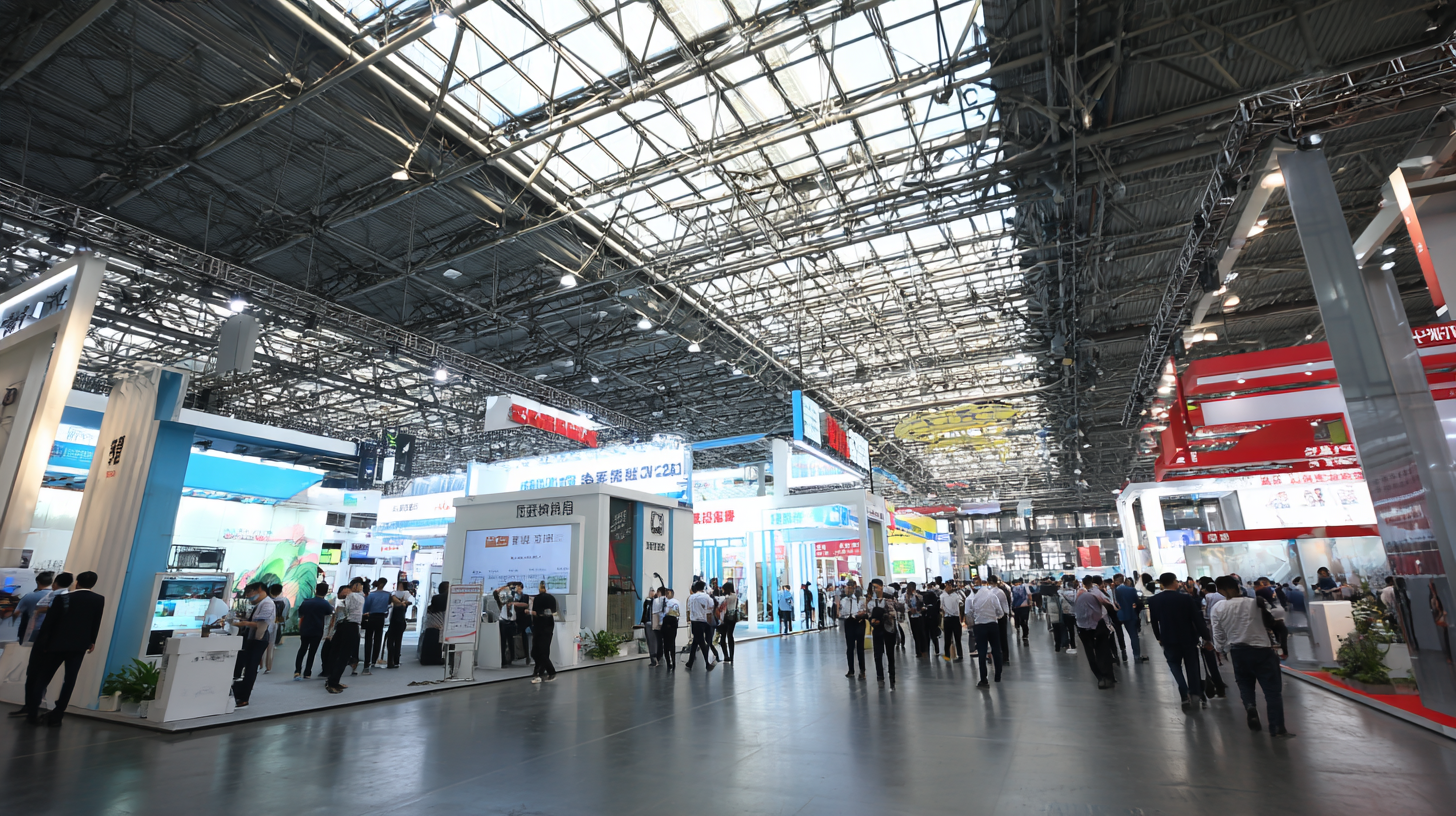

As we look ahead to the 138th China Import and Export Fair in 2025, the spotlight is set to shine on the burgeoning sector of Galvanized Metal, which plays a pivotal role in various industries such as construction, automotive, and manufacturing. According to a recent report by the Global Precipitated Calcium Carbonate Market, the demand for galvanized metal is expected to increase annually by 4.8%, driven by its durability and resistance to corrosion. Furthermore, the growth of urbanization and infrastructure projects in emerging markets is anticipated to bolster this trend. At the forefront of these discussions will be innovative applications and advancements in galvanized metal technologies that promise enhanced performance and sustainability. As manufacturers gather to showcase their latest offerings, the implications for the future of galvanized metal could not be more significant, setting the stage for transformative developments in the global marketplace.

At the upcoming 138th China Import and Export Fair in 2025, the galvanized metal sector will be at the forefront as trends in production and demand evolve. Recent volatile market conditions prompted by international trade tensions, particularly between the U.S. and China, are expected to have significant implications for the galvanized metal industry. As tariffs fluctuate, manufacturers may need to adapt their strategies to navigate the shifting landscape, focusing on innovation and efficiency in production.

Tips for industry players include embracing technological advancements to enhance production processes and reduce costs. Investing in sustainable practices not only aligns with global trends but also meets increasing demand for environmentally friendly materials. Additionally, companies should keep a close watch on geopolitical events that could impact trade policies and adjust their supply chains accordingly to mitigate risks.

As we look to the future, understanding consumer preferences and the demand for high-quality galvanized metal will be crucial. Engaging in dialogue with policymakers and industry stakeholders can pave the way for collaborative solutions that benefit the industry as a whole, fostering growth amidst the challenges posed by market volatility and shifting trade dynamics.

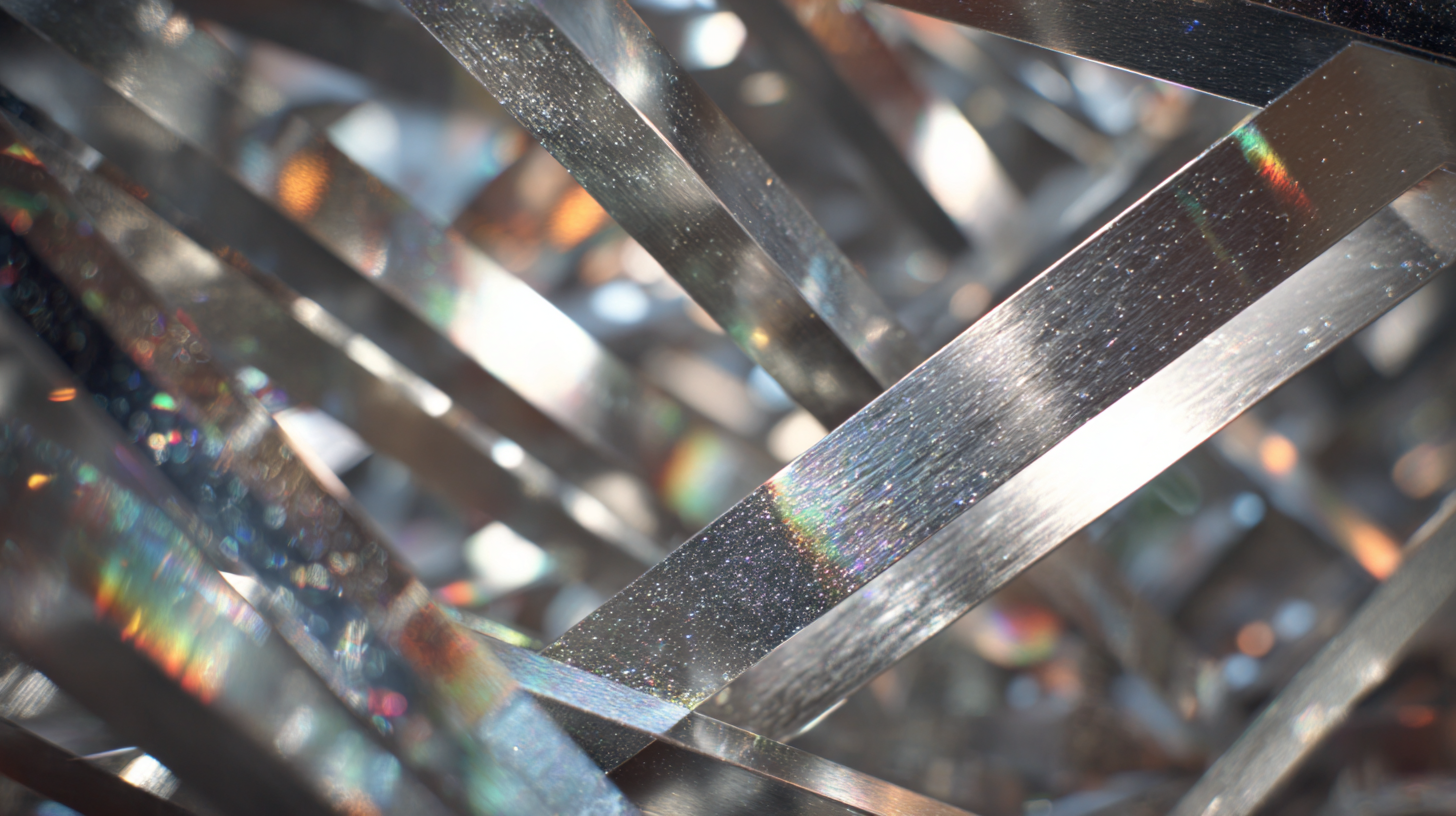

At the 138th China Import and Export Fair in 2025, the spotlight on galvanized metal will highlight the transformative effects of technological innovations on manufacturing processes. Modern advancements in automation and artificial intelligence are streamlining production, reducing human error, and enhancing consistency in the quality of galvanized products. For instance, AI-driven monitoring systems can assess the coating process in real-time, ensuring optimal thickness and improved adhesion. This level of precision not only enhances the longevity of the galvanized metal but also minimizes waste, leading to more sustainable practices within the industry.

Furthermore, continuous research in materials science is paving the way for the development of new alloys and coatings that offer superior performance. Innovations such as eco-friendly galvanization techniques are emerging, promoting reduced environmental impact without compromising metal durability. At the fair, manufacturers will showcase how these advancements contribute to lower production costs and more efficient operations, all while meeting increasing global demands for high-quality, corrosion-resistant materials. As the industry evolves, the fusion of technology with traditional galvanization will define the future landscape of metal manufacturing.

At the upcoming 138th China Import and Export Fair 2025, the spotlight will be on sustainability in the galvanized metal industry. With global metal production contributing approximately 7% of annual carbon emissions according to the World Steel Association, the need for innovative waste reduction strategies has never been more pressing. Galvanized metal, known for its longevity and resistance to corrosion, can play a crucial role in sustainable construction, reducing the frequency of replacements and thus minimizing waste.

To enhance sustainability, manufacturers are exploring the implementation of advanced coating technologies that significantly lower overall zinc consumption, with potential reductions of up to 30%. Moreover, adopting circular economy principles, such as recycling old galvanized materials, can reduce the carbon footprint associated with the production of new metal. Recent industry reports indicate that the recycled galvanized steel industry could potentially reach a market value of $15 billion by 2030, further incentivizing companies to embrace eco-friendly practices.

**Tips for Sustainability in Galvanized Metal:**

1. Evaluate sourcing strategies to include suppliers committed to reducing their carbon emissions.

2. Invest in training for employees on best practices in waste management and recycling of galvanized metal.

3. Collaborate with stakeholders to establish a robust recycling program to ensure the sustainable lifecycle of galvanized products.

As we look towards the future of the galvanized metal sector, particularly surrounding the 138th China Import and Export Fair in 2025, it becomes imperative to analyze the market dynamics that will shape its trajectory. According to a recent report by MarketsandMarkets, the global galvanized steel market is projected to reach USD 72 billion by 2025, growing at a CAGR of 6.8%. This growth is driven by the increasing demand for automotive and construction applications where corrosion resistance is critical.

However, challenges loom on the horizon, particularly with the rise of sustainable and eco-friendly alternatives. A report from Grand View Research indicates that the push towards sustainable materials could pose a significant threat to the galvanized metal market. Innovations in eco-friendly coatings and the recycling of metals are gaining traction, which may impact the traditional galvanized metal sector.

Companies need to adapt by investing in research and development, ensuring they remain competitive amidst these evolving market pressures. The combination of growth opportunities and potential setbacks will create a complex landscape for galvanized metal manufacturers as they approach 2025.

The 138th China Import and Export Fair in 2025 will serve as a pivotal platform for networking within the galvanized metal industry. With the global galvanized steel market projected to reach USD 196 billion by 2025, the fair presents an invaluable opportunity for suppliers and buyers to connect and collaborate. This rapid growth is driven by increasing demand in construction and automotive sectors, which underscores the need for stakeholders to engage in meaningful discussions about industry trends, innovations, and supply chain efficiencies.

As the market continues to evolve, networking at such prestigious events can lead to strategic partnerships and insights that propel businesses forward. For example, reports indicate that Asia-Pacific is anticipated to dominate the galvanized steel market, accounting for over 45% of the global consumption. This highlights the significance of the fair for international players looking to tap into this lucrative region. Attendees can expect to meet key industry leaders, share best practices, and explore new technologies, enhancing their competitive advantage while shaping the future of galvanized metal production and distribution.

| Dimension | Description | Potential Markets | Networking Opportunities |

|---|---|---|---|

| Production Capacity | Annual output of galvanized metal | Asia, Europe, North America | B2B meetings with suppliers |

| Market Trends | Emerging technologies in galvanization | Building & Construction, Automotive | Workshops and panels |

| Sustainability Practices | Eco-friendly galvanizing processes | Green Building, Renewable Energy | Networking luncheons |

| Export Regulations | Compliance with international standards | Global Trade, Emerging Markets | Informal meet-and-greets |

| Innovative Products | New galvanized metal applications | Furniture, Electricals | One-on-one consultations |